A self-directed IRA is really an amazingly impressive investment motor vehicle, but it’s not for everyone. As being the saying goes: with great electricity will come great responsibility; and having an SDIRA, that couldn’t be more true. Continue reading to master why an SDIRA may well, or may not, be for you.

Nevertheless there are various Added benefits affiliated with an SDIRA, it’s not without the need of its individual disadvantages. A few of the typical reasons why traders don’t pick SDIRAs consist of:

This involves comprehension IRS laws, managing investments, and avoiding prohibited transactions that could disqualify your IRA. An absence of knowledge could bring about costly errors.

Put only, should you’re seeking a tax effective way to develop a portfolio that’s more tailor-made on your pursuits and experience, an SDIRA may be The solution.

Regardless of whether you’re a fiscal advisor, investment issuer, or other money Experienced, explore how SDIRAs could become a robust asset to increase your organization and achieve your Expert goals.

And since some SDIRAs which include self-directed regular IRAs are matter to essential minimal distributions (RMDs), you’ll need to approach forward to make certain that you've more than enough liquidity to satisfy The foundations set by the IRS.

Be accountable for how you expand your retirement portfolio by using your specialized knowledge and pursuits to speculate in assets that healthy with all your values. Obtained abilities in real estate property or personal equity? Utilize it to assist your retirement planning.

Property is among the most well-liked choices between SDIRA holders. That’s due to the fact you can put money into any sort of property that has a self-directed IRA.

Have the liberty to speculate in Nearly any type of asset using a chance profile that matches your investment tactic; including assets that have the potential for a greater rate of return.

Including cash straight to your account. Bear in mind contributions are subject matter to annual discover this info here IRA contribution boundaries set via the IRS.

IRAs held at financial institutions and brokerage firms provide confined investment alternatives for their customers because they don't have the abilities or infrastructure to administer alternative assets.

Purchaser Assistance: Look for a supplier which offers dedicated assist, which includes access to educated specialists who will answer questions about compliance and IRS rules.

Unlike stocks and bonds, alternative assets will often be more difficult to market or can feature demanding contracts and schedules.

Restricted Liquidity: Most of the alternative assets that could be held in an SDIRA, like real estate property, private fairness, or precious metals, might not be very easily liquidated. This can be a problem if you should accessibility money quickly.

Several buyers are shocked to learn that employing retirement resources to invest in alternative assets has actually been feasible considering the fact that 1974. Nevertheless, most brokerage firms and banking companies focus on supplying publicly traded securities, like stocks and bonds, as they absence the infrastructure and experience to control privately held assets, such as real-estate or personal equity.

Criminals in some cases prey on SDIRA holders; encouraging them to open up accounts for the goal of building fraudulent investments. They frequently idiot buyers by telling them that In the event the investment is acknowledged by a self-directed IRA custodian, it should be authentic, which isn’t real. Once more, make sure to do extensive homework on all investments you choose.

When you finally’ve discovered an SDIRA company and opened your account, you may well be wondering how to actually start off investing. Understanding both equally the rules that govern SDIRAs, in addition to the way to fund your account, might help to put the inspiration for any future of thriving investing.

Just before opening an SDIRA, Continue it’s essential to weigh the likely advantages and drawbacks determined by your certain fiscal targets and danger tolerance.

Higher Fees: SDIRAs frequently come with higher administrative costs in comparison with other IRAs, as particular elements of the executive course of action can't be automatic.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Molly Ringwald Then & Now!

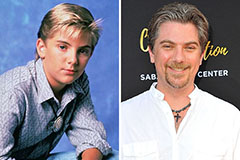

Molly Ringwald Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now!